The Shooting Star Candlestick Pattern

.jpeg)

.jpeg)

Trading on the news: turning information into profit

Trader level (Beginner)

Type of strategy (Universal)

Timeframe (60-300 m)

Assets to trade (Currency pairs, Indices, Cryptocurrency)

The strategy for trading on the news is quite interesting. The economic calendar publishes events that might affect an asset and based on the results of those events, a trade is concluded. However, there are a few subtleties that are worth paying attention to.

Knowing the time the statistics will be released, the trader can draw up a trading plan for UP/DOWN trades with assets that will be affected by this information.

For the trading on the news strategy, it is worth using information leads, data that quite often does not meet expectations. For example, data on the United States periodically show discrepancies with the opinions of analysts, which makes the price move UP or DOWN. It is the discrepancy in data that is the driver of price growth/decline. The trader makes their trade after the release of the macroeconomic figures. This option is good because you already know how the published data correlates with the forecasts and the previous values.

The trading on the news strategy is suitable for any asset, without exception. The calendar of events publishes statistics from different countries, and they do it daily.

Example of trading on the news

STEP 1

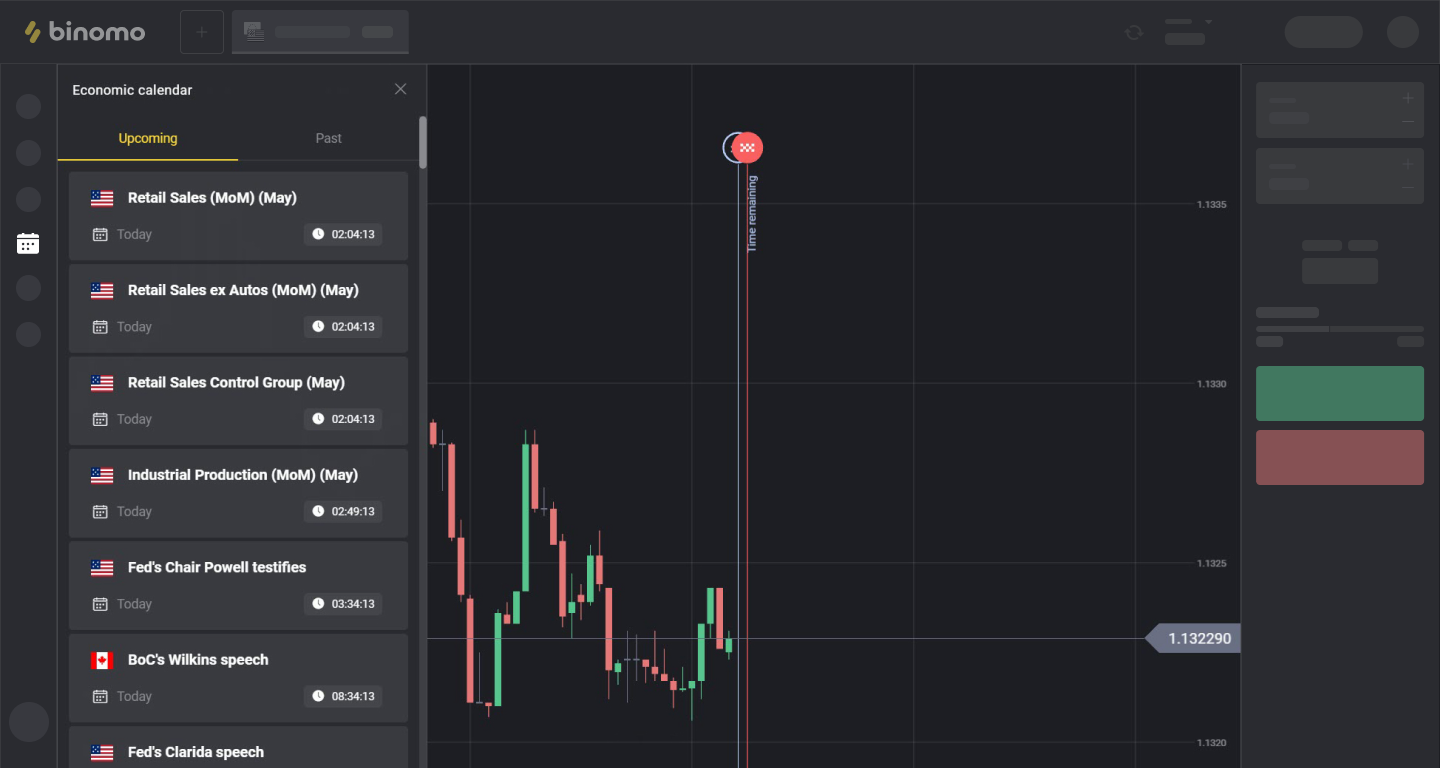

Select the “Economic calendar.” The calendar is updated in real-time.

STEP 2

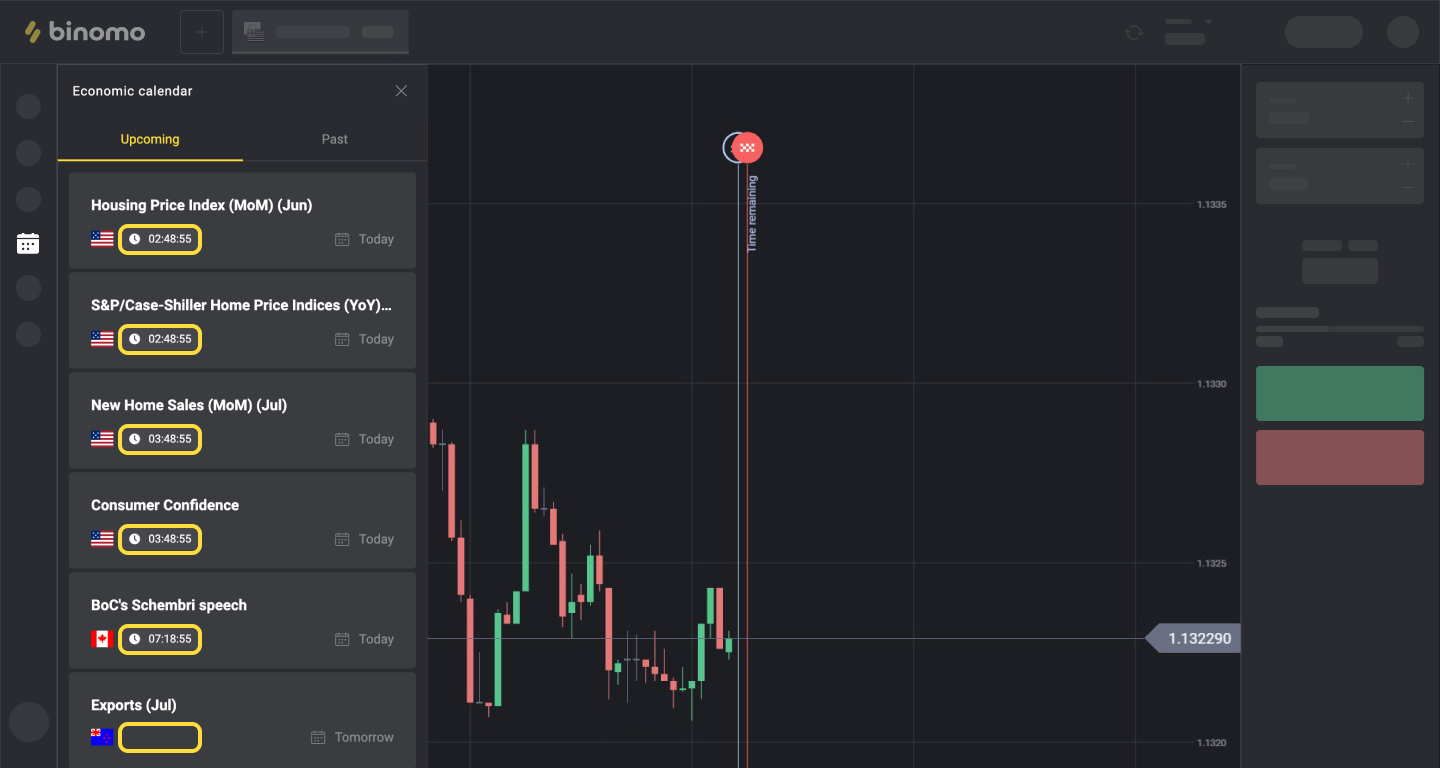

Look at how much time there is before the news release and choose the most convenient time for our trade.

STEP 3

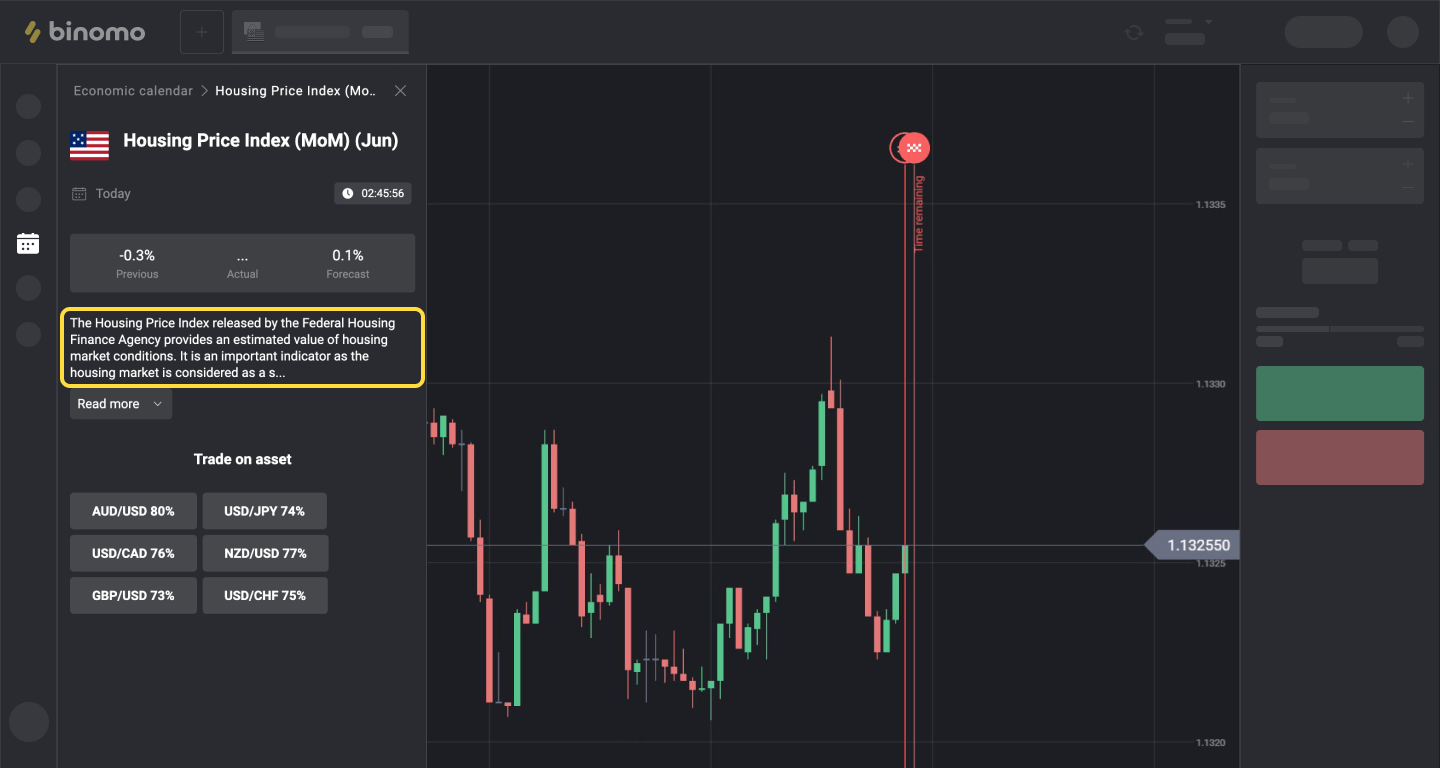

We read the description of the indicator. Understanding this is necessary for further analysis and forecasting when making a trade.

STEP 4

We choose a currency pair to conclude the trade with. This displays the currency pairs whose prices may rise or fall due to the release of this economic news event. We know that at least one of these assets will work for us.

STEP 5

Let's look at the values in the “Previous (value)” and “Forecast” fields. Before the news release, the “Actual” area remains empty. These are the values that we consider when analyzing the news. It is the numbers displayed in these fields that the trader should pay attention to first of all.

STEP 6

Shortly before the news release, we select the most profitable asset (or more than one) of those that the news impacts to conclude the trade with.

STEP 7

We make our trade based on analysis (comparison and conclusions) of the data from the “Previous” and “Forecast” fields on the selected asset shortly before the news release or based on the data from the “Actual” field during or immediately after the news release.

In this example, the news was being "processed" for almost 10 minutes, allowing us to open successful trades on an uptrend:

Comments

Post a Comment