The Shooting Star Candlestick Pattern

.jpeg)

.jpeg)

Puria Method Indicative Strategy

Trader level (Experienced)

Type of strategy (Trend)

Timeframe (5-300 m)

Assets to trade (Currency pairs, Indices, Cryptocurrency)

The “Puria Method” trading system has existed for a very long time. Many exchange traders choose it for its simplicity and efficiency. If you have not heard of it or have never put it into practice, now is the time! Let's see how it works.

Step 1: Indicator setup

Plot MACD with these settings:

• Fast period 15;

• Signal period 1

• Slow period 26;

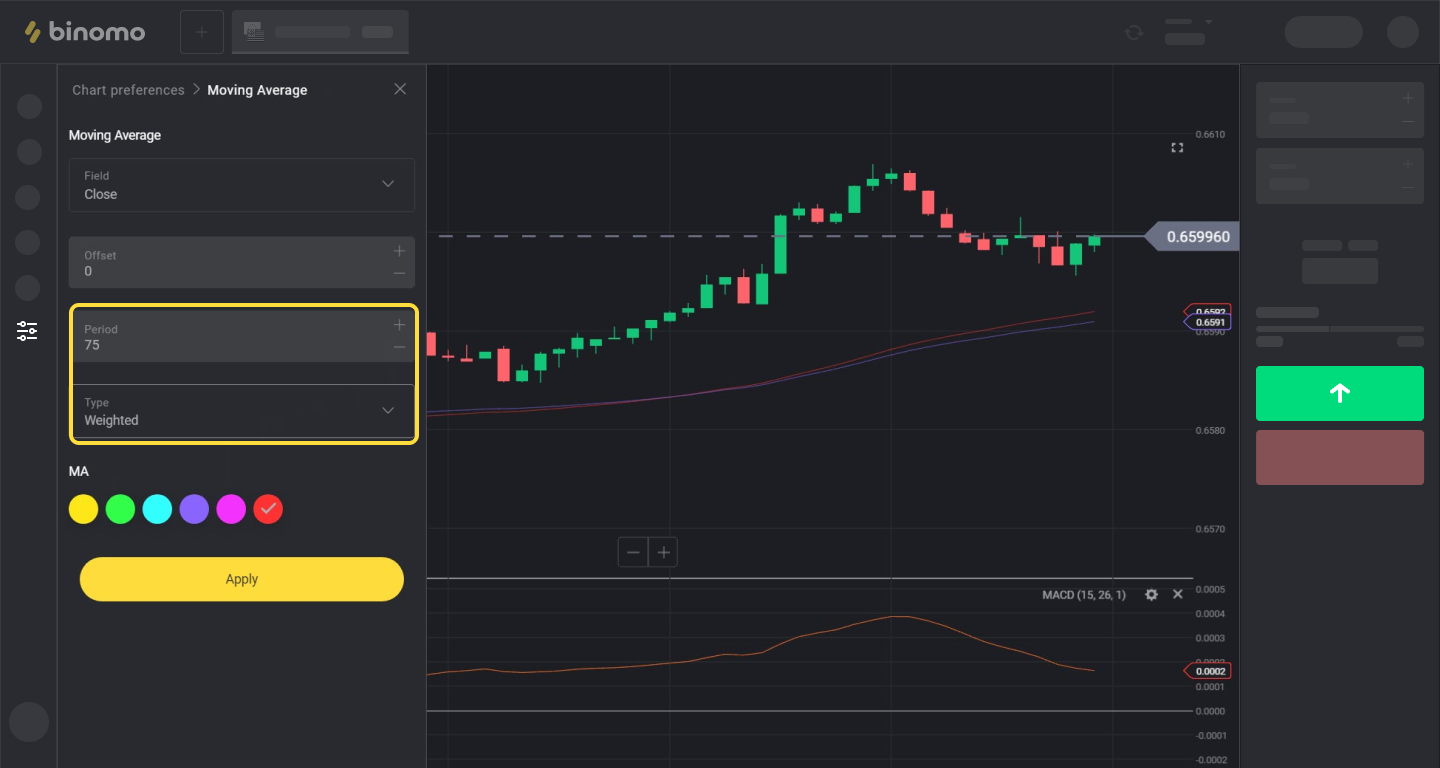

Plot the 1st Moving Average with these settings:

• Period 75

• Type Weighted;

• Red color.

Leave the remaining settings unchanged.

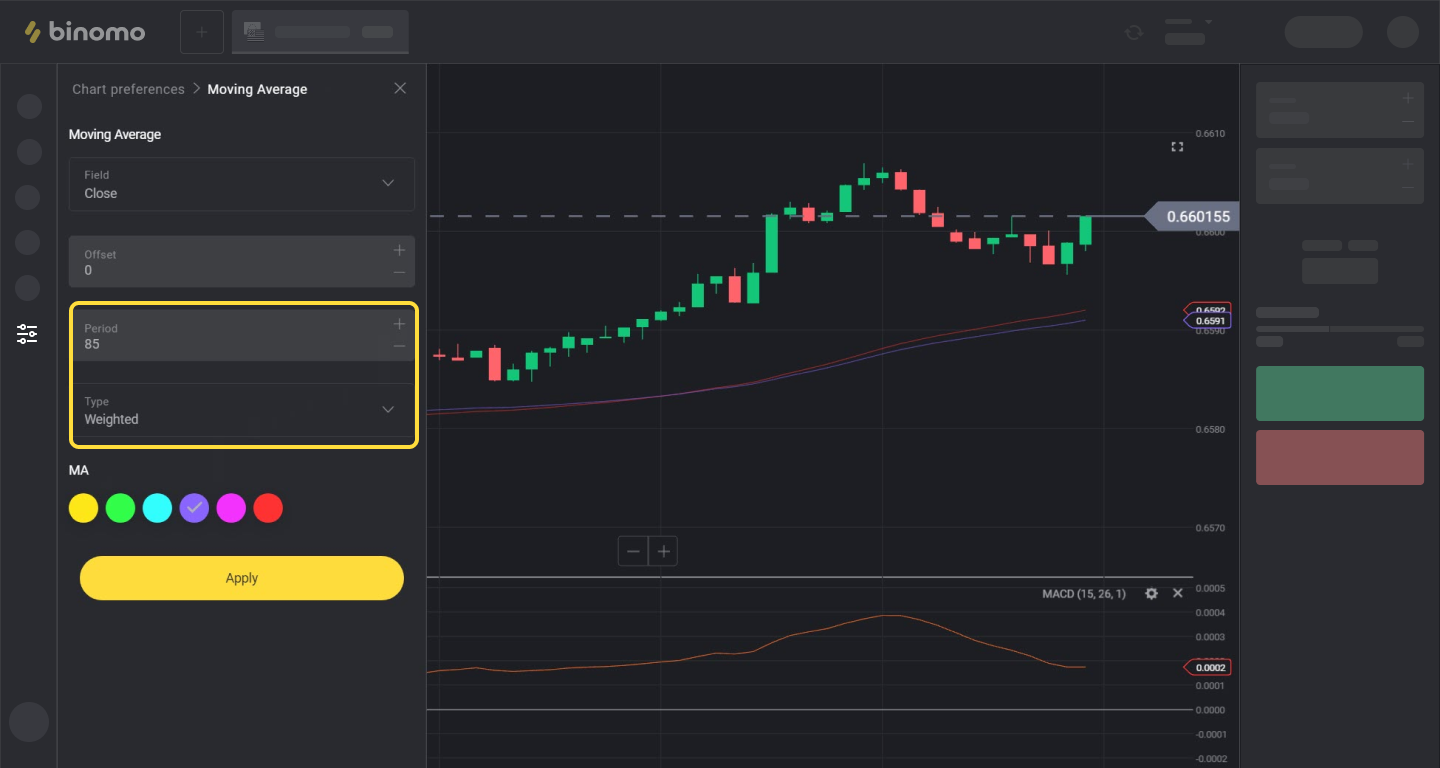

Plot the 2nd Moving Average with these settings:

• Period 85

• Type Weighted;

• Purple color.

Do not modify the remaining settings.

The key principle of the Puria Method is follow the trend.

2 Moving Averages will help you determine the trend, and MACD (the Moving Average Convergence-Divergence) will help you spot the incipient wave of an up- or downtrend.

Step 2. Choose the time frame and expiration of your trades

It’s best to choose a short time frame, or you'll have to wait a long time for signals.

Step 3: Make trades

Trade UP when the following happens:

Trade DOWN when the following happens:

Comments

Post a Comment